Working Capital forecast

Balance Sheet / WoCa

What Balance Sheet serves, what are the parts of B/S

Balance Sheet traditionally consists of the following parts:

- Balance (all items are accumulated since the beginning of the year)

- Working Capital (WoCa) or cash flow

- Assets (current), positive values:

- Accounts Receivable (A/R)

- Inventory

- Liabilities (short-term obligations), negative values:

- Accounts Payable (A/P)

- Assets (current), positive values:

- Assets (long-term): property, etc.

- Liabilities (long-term obligations): loans, etc.

- Equity

- Working Capital (WoCa) or cash flow

Every month, company management revises the current balance sheet representing the snapshot of business performance. While part of the components is very stable over time (long-term assets and liabilities and equity), the working capital can change quickly and WoCa or Cash Flow is the important measure of company health.

WoCa: Why predict?

WoCa shows the health of the company to the date (YtD). However, for modern CFO and CEO, the knowledge about future performance is more important. If it will demonstrate degradation, some urgent actions should be undertaken.

WoCa: How to predict?

There are basically two approaches and they can be mixed in various proportions.

First approach is rule-based and completely human-driven. Analysts contact operations, sales, procurement, collect all required data on expected costs and income and shape the forecast. There are three problems with this approach: even if all procedures are well established the process can take up to three weeks every quarter. The quality of forecast depends on quality of information dispatched from other teams. This forecast can be very precise for upcoming quarter because it is based on documents / contracts, and significantly degrade in quality at 6-12 month horizon. It is also difficult for analysts to include additional drivers in their model. The significant benefit of this approach is in the fact that every predicted figure can be traced back to the source, and exactly explained to CFO.

Another approach is completely AI/ML-driven. This means, computer builds its own statistical model based on historical records of WoCa, searches for repetitive patterns, and dependencies from internal and external factors. Then, the model can build forecasts. There are various levels of modelling - from simple linear regression to deep-learning, as more sophisticated model used as difficult it becomes for explanation. This problem of explanation exists even for linear regression. If we say, this WoCa item can be forecasted as 0.12 ** sales + 3.5 ** previous month WoCa - 2.7 ** inflation, then every finance analyst would ask: Why? Why these three, why in this proportion? Why salary doesn't drive this item? They are unable sub-sequentially explain this to CFO. However, there are several features that overweight this obstacle. AI-driven forecast is fast. In our experience, it is possible run full detailed WoCa forecast in 45 minutes even for the huge multinational corporation. It has the same accuracy as traditional approach, even at the short-time horizon. It uses facts taken from trusted sources and doesn't depend on the completeness of information exchange between humans.

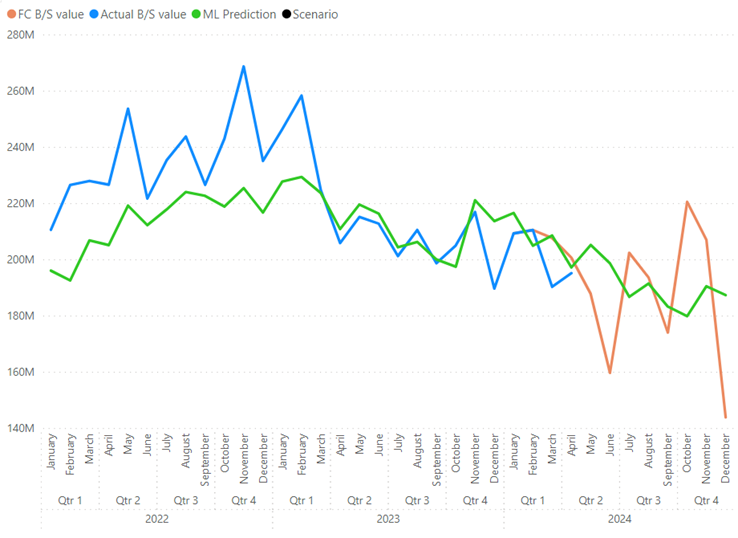

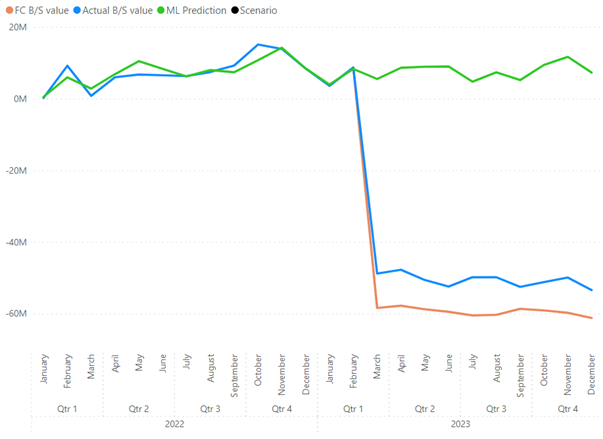

This picture above illustrates the inventory forecast for the specific market and specific product. Blue line represents actual value, green line is generated by ML model (forward and backward (from April 2024). Orange line is human prediction. You see that it tends to depend on the quarterly sales structure of the business.

This is exactly the reason why we recommend

- Always control results of AI models/

- Share the possible changes in business accounting rules or any other relevant information with model support team/

- Choose a hybrid model, where some WoCa items are still manually forecasted.